In a case that highlights the growing sophistication of online fraud schemes, a 36-year-old Nigerian man, Okezie Ogbata, has pleaded guilty to defrauding more than 400 elderly and vulnerable victims in the United States of over $6 million.

Ogbata admitted his role in a complex inheritance scam before the Southern District Court in Florida, United States. He faces up to 20 years in prison when sentenced by Judge Roy Altman on April 14, 2025.

Details of the Scam

According to the U.S. Department of Justice (DoJ), Ogbata and his co-conspirators devised a scheme to manipulate unsuspecting victims by sending fraudulent letters. These communications falsely claimed to be from representatives of a bank in Spain, informing recipients of a multimillion-dollar inheritance allegedly left by a distant relative who had passed away overseas.

Victims were instructed to pay delivery fees, taxes, and other charges to claim the fictitious inheritance. Many of these payments were made under duress, with the scammers warning that failure to comply could lead to legal trouble with government authorities.

“These criminals exploited the trust and vulnerabilities of their victims to extract significant amounts of money,” a DoJ statement said.

Who Were the Victims?

Most of the victims were elderly Americans, a demographic often targeted in scams due to their limited familiarity with modern fraud tactics and, in some cases, their isolation.

Ogbata and his accomplices orchestrated the fraud across state lines and even internationally, complicating efforts to track and stop the criminal operation. Investigators confirmed that the scheme involved over 400 victims, resulting in a staggering loss exceeding $6 million.

A Coordinated Response to Transnational Crime

The case was part of a broader crackdown on transnational financial fraud by U.S. authorities. The investigation was conducted in collaboration with international law enforcement agencies, showcasing the importance of global partnerships in tackling organised crime.

General Brian Boynton, head of the Justice Department’s Civil Division, emphasised this in a statement:

“This case is a testament to the critical role of international collaboration in tackling transnational crime. The Department of Justice will continue to work with our partners to bring fraudsters to justice, no matter where they operate.”

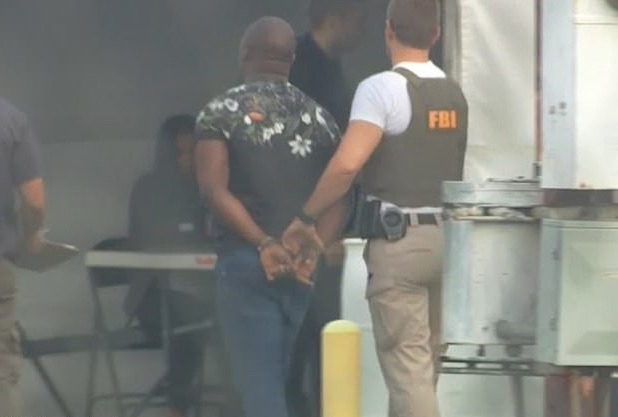

The FBI and U.S. Postal Inspection Service led the investigation, with support from international bodies to uncover the layers of deception and prosecute those involved.

Background on Inheritance Scams

Inheritance scams, like the one operated by Ogbata, have become alarmingly common in recent years. These schemes often prey on individuals’ hopes of financial gain while exploiting their lack of access to immediate legal advice or resources.

According to the U.S. Federal Trade Commission (FTC), such scams are part of a larger trend of “imposter fraud,” which accounted for losses of over $2 billion globally in 2023. Fraudsters frequently use fake identities, official-looking documents, and elaborate narratives to lend credibility to their schemes.

Nigeria’s Fight Against Fraud

Nigeria has long struggled with the stigma of being associated with fraud, especially the infamous “419 scams” of the 1990s. While the Nigerian government has worked to crack down on such crimes, incidents like Ogbata’s case continue to damage the country’s reputation internationally.

Local experts suggest that economic challenges and unemployment have driven some individuals toward online scams. However, Nigeria’s Economic and Financial Crimes Commission (EFCC) has been actively collaborating with international agencies to prosecute offenders and recover stolen assets.

An EFCC spokesperson, speaking anonymously, commented:

“We remain committed to addressing financial crimes and restoring Nigeria’s image globally. Cases like this remind us that more needs to be done to prevent fraudsters from tarnishing the country’s name.”

Legal Consequences

Ogbata’s guilty plea may bring some relief to the victims, many of whom lost their life savings in the scam. However, the emotional and financial toll on the victims remains significant.

Legal analysts believe that the case sends a strong message to other potential fraudsters. Ogbata could face the maximum penalty of 20 years in prison, although sentencing guidelines and plea agreements may reduce the final sentence.

In addition to prison time, the court may order restitution payments to the victims, ensuring they recover at least part of their losses.

Public Awareness Is Key

Experts have stressed the need for increased public awareness to combat such fraud schemes. Families are encouraged to educate elderly relatives about the risks of unsolicited letters, emails, or phone calls promising financial windfalls.

U.S. officials have also urged banks and other financial institutions to implement stronger anti-fraud measures, particularly for high-risk demographics.